| |

The media seems to be piling on Richmond, finding things to criticize about the plan to use eminent domain if necessary to buy underwater mortgages. Why the media would start taking the side of Wall Street is unfathomable.

The U.S. Financial Crisis Inquiry Commission reported its findings in January 2011. It concluded that "the crisis was avoidable and was caused by: Widespread failures in financial regulation, including the Federal Reserve’s failure to stem the tide of toxic mortgages; Dramatic breakdowns in corporate governance including too many financial firms acting recklessly and taking on too much risk; An explosive mix of excessive borrowing and risk by households and Wall Street that put the financial system on a collision course with crisis; Key policy makers ill prepared for the crisis, lacking a full understanding of the financial system they oversaw; and systemic breaches in accountability and ethics at all levels.

All of the above are politicians, bureaucrats or parts of Wall Street. Only one component is the household that took excessive risk in borrowing money his banker assured him he would be able to pay back. Every entity mentioned above got bailed out by the government except those at the end of the food chain, the homeowners holding the underwater mortgages. Banks, especially, are so awash with money today they can’t find uses for it.

What Contra Costa Times curmudgeon-in-chief fails to recognize is that whoever hold these mortgages is going to lose one way or another, and they will likely lose more money through a foreclosure than they would lose under a clean purchase of the mortgage at market value. Foreclosed properties in Richmond are often vandalize and stripped of copper pipe and wiring. Some get as much as $30,000 fines from Code Enforcement for being a public nuisance. Then there are the legal and brokerage fees and costs of the foreclosure and eventual resale of a devalued vandalized home. The eminent domain plan can actually save mortgage holders money.

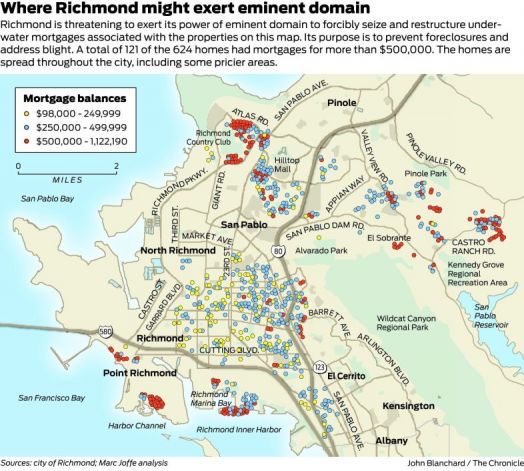

The Chronicle article points out that some of the underwater homes are in the more expensive neighborhoods of Point Richmond and Brickyard Cove, but most of them are in the Richmond flatlands between I-80 and I-580, Hilltop and the El Sobrante Valley. If deleted from the plan, as discussed by Patrick Lynch, ones in Point Richmond and Brickyard Cove will go through foreclosure anyway, and the worst thing is that we’ll eventually get some new neighbors, but the mortgage holders will still lose their equity. The hundreds of homes located in other parts of Richmond are a real problem and constitute blight that brings the whole city down.

Barnidge: Richmond stirs more controversy with its eminent domain plan

By Tom Barnidge Contra Costa Times Columnist

Posted: 08/19/2013 11:43:07 AM PDT | Updated: about 8 hours ago

By now, we shouldn't be surprised by any story involving the Richmond City Council. Whether it's a highly unpopular ballot measure for a one-cent-per-ounce soda tax, a council member sued for flagrant property code violations, or a call for police to restore calm at an unruly meeting, controversy surrounds Richmond's governing body like no other in the East Bay.

But all the fun and fireworks pale in comparison to its current plan to use eminent domain to seize underwater mortgages and provide cheaper loans for homeowners through a third-party lender. Current mortgage holders would be forced to release claims on selected properties for a "fair value" determined by the city -- say, 80 percent of market price -- and new loans would be offered by Mortgage Resolution Partners.

You can see why folks who prefer smaller monthly mortgage payments might like this deal. It greatly reduces the debt they're obliged to pay. But what of the obvious hairball in this soup? If the city can whimsically seize and discount mortgages through eminent domain, why would any lender again fund another home purchase in Richmond?

That this approach seems to distort the definition of eminent domain -- the government's right to take private property for public use -- is another tiny concern. Allowing a select group of borrowers to skip out on their debts wouldn't seem to be a "public use" benefit to the greater community.

Plus, MRP isn't offering its services because of its fondness for Richmond. It's doing so because there's money to be made. CalWatchdog.com, a nonprofit journalism venture in Sacramento, explains how it works:

"A home with a $300,000 mortgage is now only worth $200,000 in the open market. The mortgage reseller (MRP) would buy that $200,000 loan for, say, $160,000 based on a 20 percent discount of the value of the real estate. A new loan for $190,000 would be offered the homeowner. The mortgage reseller would make a $30,000 profit."

For now, Richmond has targeted 624 mortgages. But there are another 4,000 or so over-mortgaged homes in the city. Who knows how much further this practice will spread?

Then, there's another consideration that's barely been mentioned in what Mayor Gayle McLaughlin has positioned as a crusade against predatory lenders.

Individual banks typically do not hold these mortgages. They more often are held as mortgage-backed securities in the secondary market -- retirement plans, 401(k)s and pension funds such as CalPERS -- which would absorb the losses resulting from the loan seizures. So Richmond's actions wouldn't punish banks so much as they'd punish individuals and pensioners.

This idea is so brilliantly outlandish it could only originate in Richmond, the first city in the nation to use eminent domain as a weapon against lenders.

Oh, one other thing, as reported by Alejandro Lazo of the Los Angeles Times on Aug. 13: The feds are uneasy about this plan. The newspaper quoted a letter by Elliot Mincberg, an assistant secretary at the Department of Housing and Urban Development: "Pending legal developments and possible further execution of the plans in question, HUD does not know whether any new mortgage which might be created would qualify for insurance by the Federal Housing Administration."

Otherwise, it sounds like a heckuva plan.

Contact Tom Barnidge at tbarnidge@bayareanewsgroup.com.

Pricey homes in Richmond's eminent domain plan

Carolyn Said

Updated 11:07 pm, Monday, August 19, 2013

Richmond Country Club: Sold for $982,500. Loan balance: $781,996. City's offer: $257,543. Value: $499,910. Photo: Brant Ward, The Chronicle

Richmond's controversial plan to seize underwater mortgages through eminent domain includes loans for at least two homes purchased for over $1 million as well as other high-end properties - a revelation that appears to undermine the city's argument that the plan would combat blight. Richmond's controversial plan to seize underwater mortgages through eminent domain includes loans for at least two homes purchased for over $1 million as well as other high-end properties - a revelation that appears to undermine the city's argument that the plan would combat blight.

The city is pursuing mortgages with balances ranging from $98,000 to $1.12 million, according to data collected by Marc Joffe, an analyst who received the property addresses, loan balances, offer amounts and other information through a California public records request and shared them with The Chronicle.

Richmond threatened last month to become the first city in the country to invoke eminent domain for underwater mortgages when it sent letters to 32 banks and other entities asking to purchase 624 home loans at a discount to current property values. If the institutions declined, the city said it would consider forcibly acquiring the mortgages through eminent domain. It would then help the homeowners refinance into smaller, more-affordable loans.

Eminent domain is the seizure of private property for a public purpose. City leaders argued that the public purpose is to keep families in their homes and prevent blight and the destabilizing impact of foreclosures. Banks say the plan is unconstitutional and would drive up lending costs in Richmond.

The data show the targeted loan balances are fairly high. A total of 121 loans are for over $500,000, with 43 above $600,000. The average loan balance is $387,800; the median is $378,920.

Richmond's offers, which are closer to what it considers current market value, include 30 for more than $400,000 and 108 for above $300,000. The average offer is $202,678; the median is $179,900.

Undercuts argument

"Richmond is framing this issue as trying to protect down-and-out people struggling to get by against the rich banks," Joffe said. "It undercuts their argument" to have higher-end homes and loans involved. "You think they'd be careful enough to select properties of people who were really needy." If the homes in upscale areas went into foreclosure, they'd be quickly purchased, Joffe said, rather than sit vacant and contribute to blight.

Joffe, a Walnut Creek resident who consults for New York's PF2 Securities Evaluations, which offers advice on structured-finance valuations and lawsuits, said he has no financial relationship with any of the entities that control the mortgages.

Steven Gluckstern, chairman of Mortgage Resolution Partners, the private San Francisco company that is providing Richmond with financial backing, technical advice and legal resources, said the location of the homes and their prior values aren't relevant.

"We don't discriminate against anyone in this program," he said. "We don't pick and choose who's entitled to their property and who isn't. The criteria for which loans were chosen is how much underwater they are and the propensity to default."

A final cut

Patrick Lynch, Richmond's housing director, said that the city sent out the letters before performing due diligence on the properties selected by MRP, but that the city would vet the choices before it would proceed with eminent domain seizures. It is quite possible that the homes in nicer areas would not make the final cut, he said.

Richmond "would look at a number of indicators," he said. "I think one of those indicators may be the assessed property valuation, not only for that house, but for the surrounding street and neighborhood. We as a city have a sense of blight different than an appraiser, so how many houses on that street are foreclosed or underwater could be an indicator, as well as the overall health of the neighborhood."

A map of the homes targeted so far shows them evenly dispersed throughout Richmond. Nine are in Point Richmond, the city's most expensive neighborhood; 14 are in neighboring Brickyard Cove, an upscale waterfront condo community. Forty-three are in Marina Bay, another waterfront condo community.

|

|