|

|

Everybody has a right to engage in political campaigning and exercise their first amendment rights. In Richmond, however, we have laws that require individuals or organizations other than candidates to disclose who they are, where their funding comes from and where they are from. Unfortunately, those laws have been flouted by big money interests who wish to conceal their identity or make it difficult to discern who they actually are. Those lawbreakers include Chevron and the backers of the Point Molate casino as well as the Richmond police Officers Association.

Although not illegal, backers of the casino and “Yes” on Measure U have not yet mentioned the word “casino” in their mailers. Clearly, they are not very proud of it.

Richmond Municipal Code Chapter 2.42.075 has detailed requirements for disclosure of contributors in mailing pieces paid for by independent committees. I am requesting that the city attorney and the city clerk take all actions available under 2.42.080 to impose penalties on the organizations responsible, including both criminal and civil actions. I am suggesting that concerned citizens join me in requesting prosecution. You can email your request to randy_riddle@ci.richmond.ca.us and diane_holmes@ci.richmond.ca.us. The specific violations are as follows:

- The mailer entitled “They Built Richmond in Its Glory Days” and “Myrna Lopez for City Council – Making Richmond Work Again,” was paid for by “Jobs Now” that lists the major funder as Chevron Corporation but does not list by whom the expenditures were directed. The bottom one-quarter of the front page with the disclosure has margins that exceed ½ inch on three sides. It may be splitting hairs to invoke the out-of-city contributor disclosure requirement, but technically Chevron Corporation is not located in Richmond. The address of its “principal place of business” is clearly 6001 Bollinger Canyon Road, San Ramon, CA 94583-2324. There are a dozen Chevron subsidiaries and affiliates in Richmond, but there is no address and no business license listed for “Chevron Corporation.” The address given is a post office box, so it’s impossible to tell where the source is actually located.

- The mailer with the return address of “BMW, 351 South 39th Street” states that major funding is by Veolia Development wastewater treatment and recycling, Richmond Police Officers association, Auto Warehousing automobile importing, Professional Finishing vibratory deburring, Richmond Firefighters Association with expenditures directed by Lonnie Washington. The bottom one-quarter of the front page is not exclusively devoted to the disclosure, and it has margins that exceed ½ inch on three sides.

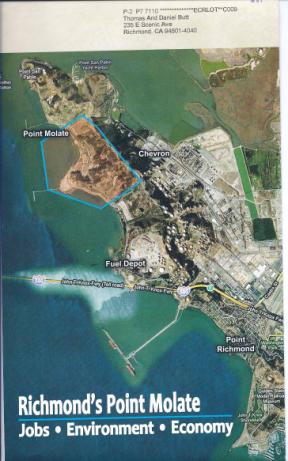

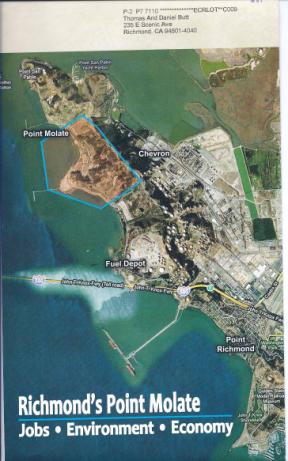

- The mailer entitled “Richmond’s Point Molate Jobs, Environment, Economy” sponsored by Winehaven Partners LLC and the Guidiville Indian Tribe does not conform to the requirements to read “major funding by…” and does not does not list by whom the expenditures were directed. The disclosure is not on the front page as defined by 2.42.075.c. The bottom one-quarter of the back page where the disclosure resides is not solely used for the disclosure, and the margins of the disclosure exceed ½ inch on two sides. The disclosure does not reveal major funding from large out of town contributors, including Winehaven Partners LLC and the Guidiville Indian Tribe. Using the address of a local business does not does not conform to the intent of 2.42.075(2). The address used (770 South 13th Street) is that of Ted Smith, Consultant, who has a business license. Neither Winehaven Partners LLC nor the Guidiville Indian Tribe have a business license in the City of Richmond. Winehaven Partners LLC is a limited liability corporation formed in Delaware on Dec. 20, 2007, registered to do business in California on April 21, 2008, from an address that traces back to Jim Levine’s Emeryville office. The Guidiville Tribe’s website lists its contact as “Guidiville Tribe, Upstream Point Molate LLC, 1900 Powell Street, 12th Floor, Emeryville, California 94608.”

- The mailer entitled “Get Richmond Working Again” sponsored by Winehaven Partners LLC and the Guidiville Indian Tribe does not conform to the requirements to read “major funding by…” and does not does not list by whom the expenditures were directed. The disclosure is not on the front page as defined by 2.42.075.c. The bottom one-quarter of the back page where the disclosure resides is not solely used for the disclosure, and the margins of the disclosure exceed ½ inch on two sides. The disclosure does not reveal major funding from large out of town contributors, including Winehaven Partners LLC and the Guidiville Indian Tribe. Using the address of a local business does not does not conform to the intent of 2.42.075(2). The address used (770 South 13th Street) is that of Ted Smith, Consultant, who has a business license. Neither Winehaven Partners LLC nor the Guidiville Indian Tribe have a business license in the City of Richmond. Winehaven Partners LLC is a limited liability corporation formed in Delaware on Dec. 20, 2007, registered to do business in California on April 21, 2008, from an address that traces back to Jim Levine’s Emeryville office. The Guidiville Tribe’s website lists its contact as “Guidiville Tribe, Upstream Point Molate LLC, 1900 Powell Street, 12th Floor, Emeryville, California 94608.”

- The mailer entitled “Turning Up the Beat” paid for by “Jobs Now” that advocates for Maria Viramontes lists the major funder as Chevron Corporation but does not list by whom the expenditures were directed. The bottom one-quarter of the front page with the disclosure has margins that exceed ½ inch on three sides. It does not list by whom the expenditures were directed.

The applicable portion of Richmond’s Fair Elections Ordinance follows:

2.42.075 - Disclosure of contributors to independent expenditure committees.

(a) Any committee that makes, during the calendar year in which the election is held, more than three thousand dollars in independent expenditures for or against for a candidate for city office or more than twenty-five hundred dollars in independent expenditures for or against the qualification, or passage, of a local ballot measure being voted on only in this city shall list the following information in a clear and legible manner on the bottom one-quarter of the front page of any mass mailing (delivered to residences by any means including hand delivery) by the committee in the election for which the independent expenditures were made.

(1) The names and occupations of individuals and the names and business interests of non-individuals, of the five largest contributors to the committee during the twelve months immediately preceding the date of distribution of the mass mailing, listed in order of the amount of contributions. If two or more of the largest contributors have contributed the same amount, they shall be listed according to chronological sequence of contribution. The disclosure shall read: "Major funding by: (name and occupation or business interest)." In the case of contributions from committees, the disclosure shall read: "Major funding by: (name of committee); Expenditures directed by: (name and occupation or business interest of persons or non-individuals who direct or control the expenditures of the committee)"; and

(2) If the committee has received at least one-third of its total contributions during the twelve months immediately preceding the date of distributions of the mass mailing from large out-of-city contributor(s), the whole top one-third of the disclosure shall state "Major funding from large out-of-city contributors." "Large out-of-city contributors" means those contributors

(A) who are not residents of the city and

(B) who, except for membership organizations, do not have a principal place of business in the city and

(C) whose cumulative contributions to the committee are one hundred dollars or more for the twelve month period immediately preceding the date of distribution of the mass mailing.

(b) When making the disclosures required in subsection (a)(1), the committee must use the same type size for all words in that disclosure. When making the disclosures required in subsection (a)(2), the committee must use the same type size for all words in that disclosure. The left and right and top and bottom margins of the disclosures shall not exceed one-half inch. The space between lines of type shall not be more than one-half of the type size. The committee must list each contributor on a new line. The committee shall use the bottom one-quarter of the front page of the mass mailing solely for the purpose of making the disclosure required in subsection (a).

(c) For purposes of this section "front page" shall mean the envelope, page, or panel where the address is, or in the case of unaddressed items, any outside panel.

(d) This section does not apply to communications from an organization to its members.

2.42.080 - Penalties and enforcement.

(a) Penalties.

(1) Criminal. Any person who knowingly or willfully violates any provision of Section 2.42.050 or 2.42.060 of this chapter shall be guilty of a misdemeanor and upon conviction thereof shall be punished by imprisonment in the County jail for a period of not more than six months or by a fine of $5,000 for each violation, or three times the amount or value of the unlawful contribution, whichever is greater, or by both such fine and imprisonment. Any person who knowingly or willfully violates any provision of Section 2.42.070 shall be guilty of a misdemeanor and upon conviction thereof shall be punished by imprisonment in the County jail for a period of not more than six months or by a fine of $5,000 for each violation, or three times the amount not properly reported, whichever is greater, or by both such fine and imprisonment. Any person who knowingly or willfully violates any provision of Section 2.42.075 of this chapter shall be guilty of a misdemeanor and upon conviction thereof shall be punished by imprisonment in the County jail for a period of not more than six months or by a fine of $5,000 for each violation, or three times the cost of the mailing made in violation of this chapter, whichever is greater, or by both such fine and imprisonment.

(2) Civil. Any person who intentionally or negligently violates Section 2.42.050 or 2.42.060 of this chapter shall be liable in a civil action for an amount up to $5,000 for each violation or three times the amount or value of the unlawful contribution, whichever is greater. Any person who intentionally or negligently violates Section 2.42.070 of this chapter shall be liable in a civil action for an amount up to $5,000 for each violation or three times the amount not properly reported, whichever is greater. Any person who intentionally or negligently violates Section 2.42.075 of this chapter shall be liable in a civil action for an amount up to $5,000 for each violation or three times the cost of the mailing made in violation of this chapter, whichever is greater. The City Attorney is authorized to institute and prosecute any civil action pursuant to this section. Any civil penalties recovered under this section shall be deposited in the Richmond City Treasury.

(3) Personal Liability. Candidates and treasurers are responsible for complying with this chapter and may be held personally liable for violations by their committees. Nothing in this chapter shall operate to limit the candidate's liability for, nor the candidate's ability to pay, any fines or other payments imposed pursuant to administrative or judicial proceedings.

(4) Joint and Several Liability. If two or more persons are responsible for any violation of this chapter, they shall be jointly and severally liable.

(b) Enforcement.

(1) Campaign Statement Review.

(A) The City Clerk shall monitor all campaign statements and shall notify the candidate or committee of any of the following apparent violations of this chapter:

(i) Whether the required statements have been timely filed.

(ii) Whether the statements conform on their face with the requirements of this chapter.

(iii) Whether any reported contributions exceed the allowable maximums established under this chapter.

(B) The candidate or committee shall be allowed to correct any reports within five (5) days after receipt of notice of an apparent violation sent by the City Clerk.

(2) Civil Actions. The City Attorney, or any resident, may bring a civil action to enjoin violations of, or compel compliance with, the provisions of this chapter, or for civil penalties under subsection (a)(2) of this section, or both. No resident may commence an action under this subsection without first providing written notice to the City Attorney of the intent to commence an action. The notice shall include a statement of the grounds for believing a cause of action exists. The resident shall deliver the notice to the City Attorney at least 60 days in advance of filing an action for an alleged violation of Section 2.42.050, 2.42.060 or 2.42.070, or at least 10 days for an alleged violation of Section 2.42.075. No resident may commence an action under this subsection if the City Attorney or District Attorney has commenced a civil or criminal action against the defendant, or if another resident has filed a civil action against the defendant under this subsection. A court may award reasonable attorney's fees and costs to any party who obtains civil penalties or equitable relief under this subsection. If the Court finds that an action brought by a party under this subsection is frivolous, the Court may award the defendant reasonable attorney's fees and costs.

(3) Issuance of Subpoenas. The City Attorney may issue subpoenas in furtherance of his or her duties under this chapter.

(Ord. No. 13-10 N.S., §§ 1, 2, 4-6-2010)

|